The Legislature is full of good ideas that OSBA supports because they will help students and improve schools. Good ideas usually require money, though, and OSBA is careful to monitor whether those funds would be pulled from existing programs.

In recent sessions, the 2019 Student Success Act has become a pot of money tantalizing the Legislature. The act created the corporate activities tax, which is generating more than $1 billion a year tagged for education.

OSBA is intent to keep the act focused on its original aim: To provide additional money for targeted programs to raise student achievement, especially for young people from historically underserved communities. The key idea is for it to be “additional” funding, not paying for core responsibilities.

A short session like this year can be particularly challenging for education advocates to hold the focus. There isn’t much money to go around, and there isn’t much time to discuss funding choices with the Legislature.

House Bill 4084 to help foster children – a good idea without a ready funding source – illustrates the challenge.

Children in the custody of the Oregon Department of Human Services face extreme challenges with disrupted educations, lack of family support and trouble accessing services and staying in school. Foster children have graduation rates more than 30 percentage points lower than the state average, with higher-than-average rates of homelessness, incarceration and substance abuse.

HB 4084 would create a pilot program that would place a full-time “educational navigator” into three high schools to give foster children extra support.

OSBA Legislative Services Specialist Efren Zamudio says the bill presents a creative and targeted idea for addressing foster children’s unique needs and improving their academic outcomes, the kind of thing that should be funded by the State School Fund and not the Student Success Act.

“If school districts were funded at a quality education level, they could provide these innovative student supports,” Zamudio said. “In an ideal world, we wouldn’t need a pilot program to address the disproportionate outcomes for our foster youth.”

He said OSBA’s position is that meeting school districts’ widely different needs should be broadly discussed to meet Gov. Tina Kotek’s vision of overhauling education funding over the next year.

“This is why funding matters, and this is why local control matters,” Zamudio said.

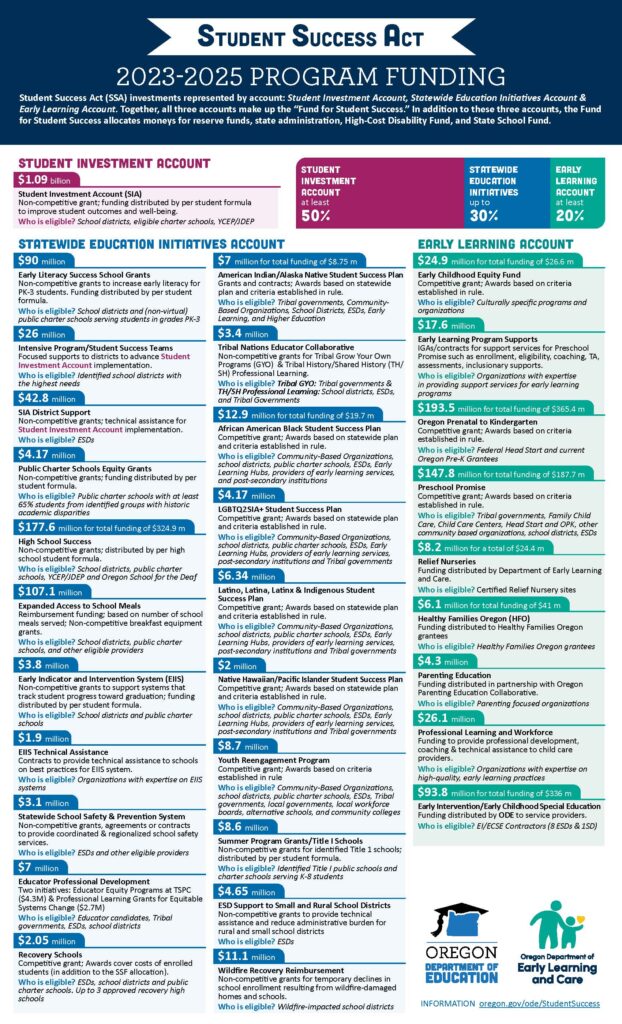

HB 4084 is seeking $1 million from the Statewide Education Initiatives Account, one of the Student Success Act’s three funding buckets:

- The Student Investment Account: Receiving at least 50% of the funds, the account creates direct grants to schools based on enrollment.

- The Early Learning Account: Receiving at least 20%, this account funds a variety of early education and support programs.

- The Statewide Education Initiatives Account: Limited to no more than 30% of available resources, the account is a catch-all that already supports more than 20 varied programs, from expanding school meals to providing educator professional development.

Education advocates are wary of any bill that dilutes the act’s support for schools.

“If we had true current service level education funding, if districts had that breathing room, our boards would have the ability to direct funds to innovative, local solutions — like the Student Succes Act envisioned,” Zamudio said.

OSBA has not taken a position on HB 4084, but guidance from the association’s membership warrants keeping an eye on it.

The OSBA Legislative Policy Committee, which consists of school board members elected to regional positions, sets OSBA’s Legislative Priorities and Principles. Top of the list is “Promote adequate, predictable, and stable funding,” followed closely by “Protect the 2019 Student Success Act.”

This session again brings bills that propose both tapping the act’s money and tinkering with the corporate activities tax.

Senate Bill 1542 would create a health care exemption in the tax and raise the minimum taxable amount from $1 million to $5 million. Together, those changes would reduce available funds for education by hundreds of millions of dollars. Education advocates are vigorously opposed.

With the first chamber deadline on Monday, Feb. 19, weeding out some bills, education lobbyists will be able to focus their efforts more sharply.

Under legislative rules, all policy committees must move bills that originated in their chamber by the deadline or the bill can’t move forward without extraordinary measures. The deadline does not apply to rules, revenue or joint committees. Bills have rocketed through these first two weeks to get to one of those safe havens.

The second chamber deadline on Friday, Feb. 23, will keep moving things along. Bills in the opposite chamber from where they started must be posted for a work session hearing by then, or they will effectively be dead. Again, bills in rules, revenue or joint committees are exempt.

HB 4084 has been sent to the Joint Ways and Means Committee and is awaiting a hearing, along with a lot of other bills legislators wanted more time with even if they might not pass this year. The short session is also a chance to try out some ideas for 2025.

SB 1542 is in the Senate Finance and Revenue Committee, another safe haven, but no further hearings have been scheduled.

With less than three weeks left in the short session, bills with the best chances will start moving to the chamber floors for votes. Because Democrats control both chambers and the governor’s office, there is rarely any suspense once a bill gets that far.

– Jake Arnold, OSBA

[email protected]