The Crook County School District’s pension rates are increasing around 12 percentage points next year.

“I’m just kind of reeling from it,” said Anna Logan, the chief financial officer. “That’s over $3 million a year in cost increase with no increased benefits for kids.”

The Public Employees Retirement System base rates will increase an average of 1.4 percentage points for Oregon school districts in 2025, according to Milliman, the state’s actuary. But that average masks the shocking number of school districts with side accounts that are seeing their actual rates double, triple or rise more, according to data published recently.

The PERS Board met Friday to adopt individual contribution rates for 2025-27. School leaders, already facing short budgets, are digesting huge new hits to their resources that add neither classroom resources nor increase staff members’ compensation.

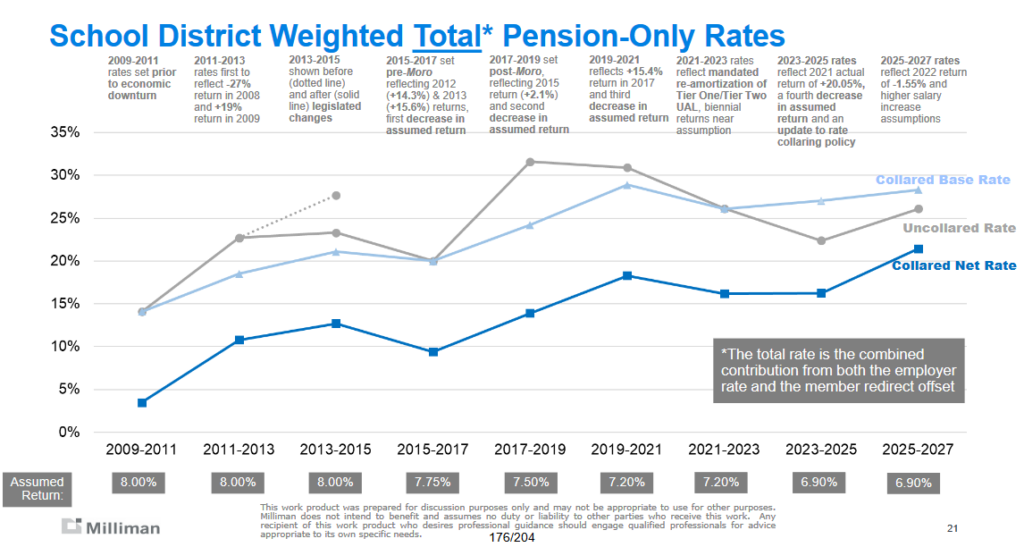

Employee costs are more than 85% of most school districts’ budgets, and PERS is a huge chunk of that. Starting in 2009, PERS costs began to rise rapidly, alarming school leaders as they watched their budgets being devoured with no measurable benefit for current staff or students. Recent PERS changes have helped flatten the climb, but PERS will still claim a projected $2.27 billion of school district budgets in 2025-27.

Side accounts are one way school districts have held down their PERS costs, but those ropes are fraying.

Side accounts are typically funded by districts selling bonds and sending the money to PERS to be invested, creating a bucket of money that PERS dips into to lower a district’s rate. The more that the side account investments earn, the more money in the bucket.

Districts make set payments over the life of the bonds out of their own budgets. If the side account earns more than the bond payments, the district comes out ahead with a PERS payment reduction greater than the loan cost. Side account earnings have ranged from -27.8% in 2008 to +20.8% in 2021.

Most districts have made money on the deal over the long haul, according to Brendan Watkins, Piper Sandler vice president, but it’s not a guaranteed win.

This biennium, district payrolls ballooned faster than predicted while investment earnings were weak. A dipperful from the side account doesn’t go as far when a district has more staff to spread it over, and the investment profits aren’t adding a lot to the bucket.

Further complicating the math, any side accounts set up before 2009, which is more than half of them, are set to finish their terms by 2027. That narrow window to spread out costs is amplifying the volatility.

The average contribution rate for school districts without a side account will be 27.2% of payroll, an average rate increase of 1.6 percentage points. The average rate for districts with side accounts is still considerably lower at 19.1%, but it is climbing an average of 7.8 percentage points. The base rate uses a mechanism called a rate collar to keep it from changing too rapidly, but the side accounts have no collar.

Individual district rates vary wildly, from practically nothing to almost a third of payroll. In addition to the side account offsets, a school’s rate depends heavily on the age and pay of its employees. Employees hired before August 2003 are known as Tier 1 and Tier 2, and employees hired after are on the Oregon Public Service Retirement Plan, with different PERS calculations.

Seventeen community colleges and 126 school districts have side accounts, according to Milliman. Many of those districts are seeing staggering jumps. The Gladstone School District, for instance, will see its Tier 1/Tier 2 rate go from 2.95% to 18.95% and its OPSRP rate go from 0.11% to 15.77%. The North Marion School District will see its Tier1/Tier 2 rate go from 1.38% to 11.97% and its OPSRP rate go from 0 to 8.79%.

“Not only is it some number that is not zero, it is some number that is well above zero,” Watkins said.

As bad as those jumps are, more hikes are ahead if districts don’t replace their side accounts. Without a side account, the average Tier 1/Tier 2 school district rate is a whopping 27.87% and the OPSRP rate is 25.03%.

Jackie Olsen, the Oregon Association of School Business Officials executive director, said districts must look at whether current interest rates make sense for seeking a new bond.

“If they don’t do it, their rates are going to go up,” Olsen said. “We know that.”

Olsen said information from Friday’s meeting will help districts determine their next steps, but districts need to act soon to replace the expiring accounts. The OASBO Fall Conference will have multiple workshops on side accounts Nov. 4.

Crook County is among the districts with a side account whose rate remains below the average for districts without one. But that doesn’t make the sudden surge any less painful.

Crook County’s rate for Tier 1/Tier 2 employees will go from 8.25% to 20.28%. Its OPSRP rate will go from 5.41% to 17.1%.

Logan said the district was expecting a 6 to 7 percentage point increase, which was already really high. The district has a $2 million PERS reserve, which it has never touched before, but that is still less than the increase.

“We’ve been trying to build for a rainy day for the past 10 years,” Logan said. “But we never expected it to hit so fast and so hard.”

– Jake Arnold, OSBA

[email protected]